Facts About Guided Wealth Management Revealed

Table of Contents4 Easy Facts About Guided Wealth Management DescribedThe Guided Wealth Management IdeasThe Single Strategy To Use For Guided Wealth ManagementGuided Wealth Management Can Be Fun For AnyoneThe Main Principles Of Guided Wealth Management Getting The Guided Wealth Management To Work

Picking an efficient economic advisor is utmost essential. Do your research and invest time to review possible monetary consultants. It serves to put a huge effort in this procedure. Conduct an examination amongst the prospects and select the most qualified one. Expert roles can differ relying on a number of elements, including the kind of monetary consultant and the client's requirements.A limited advisor should declare the nature of the limitation. Supplying proper strategies by analyzing the background, financial data, and abilities of the client.

Guiding clients to implement the monetary plans. Regular surveillance of the monetary profile.

If any issues are encountered by the management advisors, they arrange out the source and fix them. Build a financial danger assessment and assess the possible effect of the threat. After the conclusion of the danger evaluation model, the consultant will evaluate the results and supply a suitable service that to be executed.

The Basic Principles Of Guided Wealth Management

They will aid in the achievement of the monetary and employees objectives. They take the duty for the offered choice. As a result, customers need not be concerned regarding the decision.

Numerous actions can be compared to determine a qualified and skilled advisor. Usually, advisors need to fulfill conventional academic certifications, experiences and qualification suggested by the federal government.

While looking for an expert, please take into consideration qualifications, experience, skills, fiduciary, and repayments. Browse for clearness up until you get a clear concept and complete contentment. Constantly make certain that the suggestions you receive from an advisor is constantly in your ideal passion. Inevitably, economic advisors make best use of the success of an organization and likewise make it grow and prosper.

The Ultimate Guide To Guided Wealth Management

Whether you need somebody to aid you with your taxes or stocks, or retirement and estate preparation, or all of the above, you'll discover your answer right here. Keep reading to discover what the difference is between a financial expert vs planner. Primarily, any type of specialist that can help you manage your cash in some fashion can be considered a monetary advisor.

If your goal is to create a program to meet long-term economic goals, after that you most likely want to get the solutions of a licensed financial planner. You can look for a coordinator that has a speciality in tax obligations, financial investments, and retired life or estate preparation.

An economic advisor is merely a broad term to explain an expert that can aid you handle your money. They might broker the sale and acquisition of your supplies, manage investments, and help you create an extensive tax obligation or estate strategy. It is crucial to note that an economic consultant must hold an AFS certificate in order to serve the public.

Unknown Facts About Guided Wealth Management

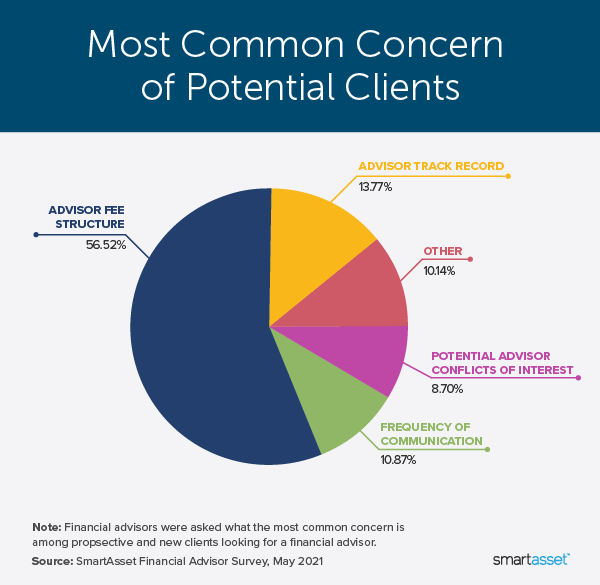

If your monetary expert lists their services as fee-only, you ought to expect a list of services that they give with a break down of those costs. These professionals do not use any type of sales-pitch and normally, the solutions are reduced and completely dry and to the factor. Fee-based advisors charge an in advance charge and after that gain payment on the financial products you buy from them.

Do a little research study initially to make sure the financial advisor you employ will certainly have the ability to deal with you in the long-term. The very best location to start is to request recommendations from family members, good friends, associates, and neighbors that are in a comparable monetary scenario as you. Do they have a relied on economic advisor and how do they like them? Asking for references is a great way to learn more about a financial expert before you also fulfill them so you can have a far better concept of exactly how to handle them up front.

The Definitive Guide to Guided Wealth Management

Make your prospective advisor address these questions to your fulfillment prior to moving forward. You may be looking for a specialty advisor such as somebody that focuses on separation or insurance policy preparation.

A monetary advisor will certainly assist you with setting achievable and reasonable goals for your future. This might be either beginning a service, a family, preparing for retired life all of which are necessary phases in life that need mindful factor to consider. A financial consultant will certainly take their time to review your circumstance, brief and long term goals and make referrals that are appropriate for you and/or your household.

A research study from Dalbar (2019 ) has highlighted that over 20 years, while the average financial investment return has been around 9%, the average investor was only getting 5%. And the distinction, that 400 basis points per year over 20 years, was driven by the timing of the investment choices. Manage your profile Protect your properties estate planning Retired life intending Manage your incredibly Tax obligation financial investment and administration You will be called for to take a danger tolerance set of questions to supply your consultant a clearer image to establish your investment asset appropriation and choice.

Your expert will take a look at whether you are a high, medium or reduced threat taker and established an asset allocation that fits your threat resistance and ability based upon the information you have actually given. A risky (high return) person may invest in shares and property whereas a low-risk (reduced return) individual might desire to invest in cash money and term deposits.

The 30-Second Trick For Guided Wealth Management

The more you conserve, you can select to spend and build your riches. As soon as you involve a financial consultant, you do not need to manage your portfolio (retirement planning brisbane). This conserves you a great deal you can look here of time, effort and energy. It is necessary to have proper insurance plan which can provide comfort for you and your household.

Having an economic consultant can be unbelievably beneficial for lots of people, but it is essential to weigh the pros and cons before making a decision. In this post, we will certainly discover the benefits and negative aspects of collaborating with a monetary advisor to help you decide if it's the best relocation for you.

Comments on “More About Guided Wealth Management”